The Central Board of Indirect Taxes and Customs on Sunday announced that single packages of food items like cereals, pulses, and flour weighing up to 25 kg will be considered as ‘prepackaged and labelled’, and liable to 5% GST from July 18. On the surge in GST rates, Finance Minister Nirmala Sitharaman informed that any increase in GST rates is envisioned to make up for inefficiencies in the value chain and also said that there was no opposition from any state on it.

Single packages of food items like cereals, pulses, and flour weighing up to 25 kg or 25 liters will fall under the category of ‘prepackaged and labeled’. Other food commodities like curd, lassi and puffed rice too would be liable to 5% GST when pre-packaged and labeled.

It also clarified that if retail shopkeepers supply in loose quantity the item bought from a manufacturer or a distributor in a 25-kg pack, such sale to consumers will not invite GST. As a result, Consumers will now have to pay more for several goods and services.

The CBIC further elaborated that the supply of pre-packed commodities e.g. Wheat flour (Atta) meant for retail sale to the customer of 25 Kg shall be liable to GST but the supply of such a 30-kg pack thereof shall be exempt from levy of GST. GST would also apply on a package that contains multiple retail packages, such as a package containing 10 retail packs of flour of 10 kg each.

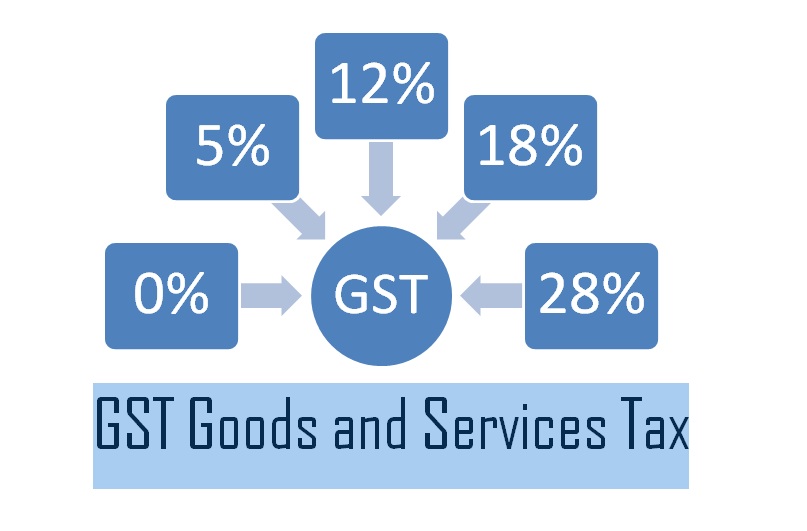

Other items which had an existing 12% GST will now be hiked to 18% and even Bank Cheques will also be charged a GST of 18% while earlier there was no tax on it.

Apart from items 5% GST will also be levied on rent rooms in hospitals above Rs 5000.

List of items that will get expensive:

- 25 kg of cereals, pulses, and flour

- Curd, Paneer, and Puffed Rice

- Knives, Paper Knives, Spoons, Forks, etc.

- LED lamps, lights, and fixture

- Printing, Writing, or drawing ink

- Prepared/finished leather

- Cut ad Polished diamonds

- Bank Cheques, lose or in book form

- Power driver water pumps and submersible pumps