Feb 15, 2020

New Delhi: Over eighty years after it was set up, the Reserve Bank of India on Saturday decided to follow April-March fiscal year, and not the current July-June, as its accounting year to align with that of the Central government.

The RBI Central Board on Saturday recommended aligning the financial year of RBI, currently July-June, with the government’s fiscal year (April-March) from the year 2020-21 and approved forwarding a proposal to the government for its consideration.

Once effected, the interim dividends and dividends will be aligned with government’s fiscal year of April-March. RBI gives interim dividends in February and final pay-outs in August currently.

The internal decision was taken last year in RBI. The Jalan panel while coming out with Economic Framework Capital had recommended change of accounting year. RBI’s current fiscal ends on June 30, 2020. Its FY 2020-21 will start on July 1, 2020 and be for nine months up to March 31, 2021. Thereafter, all FY will start on April 1 every year, aligned with the government, RBI said.

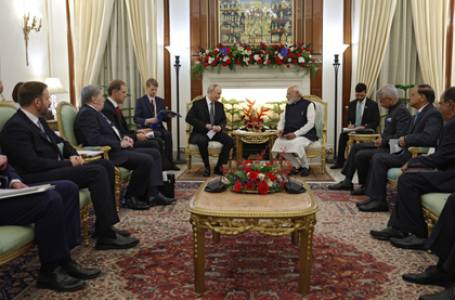

Finance Minister Nirmala Sitharaman addressed the Directors of the Central Board and outlined the thinking behind the Union Budget 2020-21 and the focus areas of the government.

The Finance Minister indicated increased complementarity in policy between the RBI and the government to address growth concerns. IANS