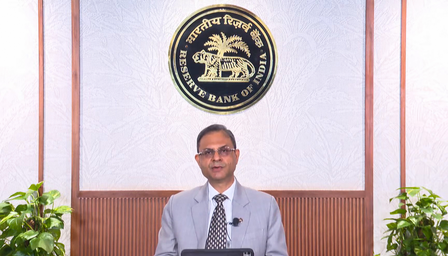

Mumbai: The RBI has revised its inflation outlook for 2025-26 downwards from the earlier forecast of 4 per cent to 3.7 per cent, Reserve Bank Governor Sanjay Malhotra said on Friday.

Taking all these factors into consideration, and assuming a normal monsoon, CPI inflation for the financial year 2025-26 is now projected at 3.7 per cent, with Q1 at 2.9 per cent, Q2 at 3.4 per cent, Q3 at 3.9 per cent, and Q4 at 4.4 per cent.

He pointed out that Inflation has softened significantly over the last six months from above the tolerance band in October 2024 to well below the target, with signs of a broad-based moderation. The near-term and medium-term outlook now gives us the confidence of not only a durable alignment of headline inflation with the target of 4 per cent, as exuded in the last meeting, but also the belief that during the year, it is likely to undershoot the target at the margin.

While food inflation outlook remains soft, core inflation is expected to remain benign with easing of international commodity prices in line with the anticipated global growth slowdown, Malhotra explained.

He pointed out that CPI headline inflation continued its declining trajectory in March-April, with headline CPI inflation moderating to a nearly six-year low of 3.2 per cent (y-o-y) in April 2025. This was led mainly by food inflation, which recorded the sixth consecutive monthly decline.

Fuel group witnessed a reversal of deflationary conditions and recorded positive inflation prints during March and April, partly reflecting the hike in LPG prices. Core inflation remained largely steady and contained during March-April, despite the increase in gold prices exerting upward pressure, Malhotra said.

The outlook for inflation points towards benign prices across major constituents. The record wheat production and higher production of key pulses in the Rabi crop season should ensure an adequate supply of key food items. Going forward, the likely above normal monsoon along with its early onset augurs well for Kharif crop prospects.

Reflecting this, inflation expectations are showing a moderating trend, more so for the rural households. Most projections point towards continued moderation in the prices of key commodities, including crude oil, the RBI Governor said.

However, at the same time, Malhotra had a word of caution. “Notwithstanding these favourable prognoses, we need to remain watchful of weather-related uncertainties and still evolving tariff-related concerns with their attendant impact on global commodity prices,” he added.

IANS