Mumbai: The Reserve Bank of India (RBI) on Friday slashed the cash reserve ratio (CRR) for banks by 0.5 per cent to make more funds available for lending to spur economic growth, but kept the key policy repo rate unchanged at 6.5 per cent with an eye on inflation.

The CRR has been reduced from 4.5 per cent to 4 per cent. This is the first time since March 2020 that the CRR has been cut. The CRR is the proportion of deposits that banks have to set aside as idle cash in the system.

The CRR cut will infuse Rs 1.16 lakh crore into the banking system and bring down market interest rates.

The monetary policy decision maintains a delicate balance between controlling inflation and pushing up the growth rate in a slowing economy,

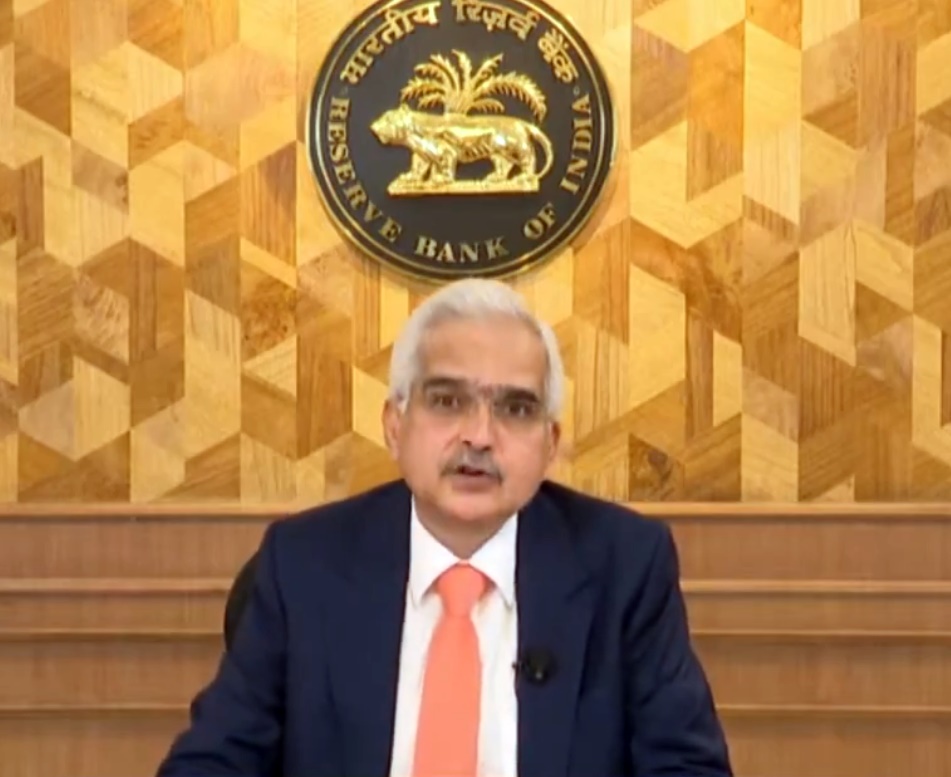

RBI Governor Shaktikanta Das said that the decision had been taken by the monetary policy committee with a 4:2 majority after a detailed assessment of the macroeconomic outlook.

He said, “India’s growth story is still intact. Inflation is on the declining path, but we cannot overlook the significant risks in outlook. This risk cannot be underestimated,”

The RBI Governor was optimistic on the outlook for the economy, observing that “the balance between inflation and growth is well poised.

He also pointed out that the country’s external sector is stable and foreign exchange reserves have scaled a new peak.

Das said that the RBI would be nimble and flexible in managing the economy. The monetary policy action gives flexibility and optionality to the monetary policy committee to keep in sync with the evolving economic outlook.

Price stability is important to people because it impacts their purchasing power, said RBI Governor Shaktikanta Das, adding that ensuring “durable” price stability is critical to ensuring high growth in the economy.

Policy support may be needed if the growth slowdown “lingers”, Das said.

For now, the central bank sees economic growth as resilient, Das said. Notwithstanding the recent aberrations in growth and inflation, domestic conditions are on a balanced path, he added.

Das also stated that there was no role for complacency, especially in the backdrop of current geopolitical conditions that trigger uncertainty in financial and commodity markets.

IANS