New Delhi: India Post Payments Bank (IPPB), which recently celebrated its eighth foundation day, known as IPPB Day, has crossed the 12-crore customer milestone, said the Ministry of Communications.

The feat marks another milestone in transforming the banking landscape by delivering inclusive, accessible, and affordable services at the last mile.

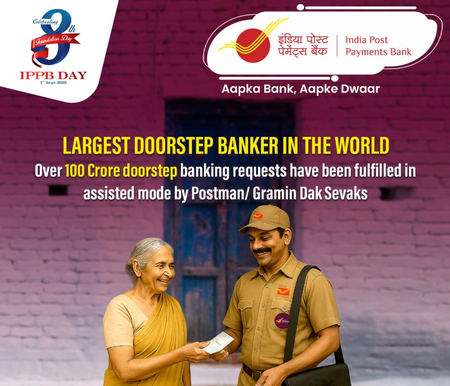

Launched in September 2018, IPPB has emerged as one of the largest financial inclusion initiatives globally. It leveraged the unmatched reach of more than 1.64 lakh post offices and more than 1.90 lakh postmen and gramin dak sevaks (GDS), the Ministry said.

“The bank has successfully onboarded over 12 crore customers, processed billions of digital transactions, and enabled doorstep banking services in rural, semi-urban, and remote regions,” it added.

“IPPB has demonstrated that financial inclusion is not just a vision but a deliverable reality. With our unique model of postal banking, we have empowered millions of Indians, particularly in rural and underserved regions, by taking banking to their doorsteps,” said Vandita Kaul, Chairman, IPPB.

“Our journey sets a global benchmark for last-mile financial service delivery. This 8th Foundation Day is even more special as IPPB has crossed the 12 Crore Customer milestone,” she added.

The Ministry also listed recent innovations that strengthened IPPB’s portfolio. The Bank has expanded into end-to-end DBT disbursements, pension payments, credit facilitation through referral tie-ups, and insurance and investment products in collaboration with partner institutions.

New offerings like DigiSmart (Digital Savings Accounts), Premium Aarogya Savings Account (Bank Account with Healthcare Benefits), and Aadhaar-based Face Authentication have added newer dimensions of customer convenience and on-demand availability of digital banking services.

The RuPay Virtual Debit Card, AePS (Aadhaar-enabled Payment Services), cross-border remittances, and Bharat BillPay integration had already made IPPB a truly comprehensive financial services provider at the grassroots.

On our 8th Foundation Day, we reflect with pride on IPPB’s role in reshaping access to financial services for over 12 crore customers. Our Postmen and GDS have become bankers for the common citizen, enabling transactions worth lakhs of crores right at people’s doorsteps. With the addition of digital payments and various customer-centric services, we are building a robust and inclusive financial ecosystem. The future of banking is at the last mile, and IPPB is leading that change,” said R. Viswesvaran, MD and CEO, IPPB.

IANS